The State of a Multi-Chain Ecosystem in 2021

We already live in a multi-chain world with more than 100 public blockchain networks. deBridge aims to be the TCP/IP of blockchains.

We already live in a multi-chain world with more than 100 public blockchain networks available. Some of these blockchains solve specific problems like scaling or privacy. Some are just forks of others with their own communities, but we can certainly assume that the number of blockchains will only grow along with the adoption of blockchain technology moving forward.

3 common challenges among blockchains

The major problem is that these chains are evolved independently and are not interconnected with each other, or interconnected through some narrow and specific channels that are often centralized and different for each specific blockchain. This leads to vital problems of ecosystem fragmentation, such as fragmentation of technologies, liquidity, and even competitive environments. Today, the problem is currently not solved since there’s no unified standard of interconnection between various blockchain networks. Let’s have a closer look into the different fragmentation areas:

- Fragmentation of technologies. Instead of pushing the overall ecosystem forward, we tend to see teams working on the same problems for different chains. There was a good point raised by MGNR. Many teams don’t even ask themselves “what problems are we solving?” but rather think “what can we fork?”, “what protocol has not been launched on this blockchain yet?”. That’s probably why there are so many forks of Uniswap, Curve, Aave and other protocols.

- Fragmentation of liquidity. Liquidity is fragmented not only between DEXs but also among blockchains themselves. Within one specific blockchain, this problem is solved by aggregators like 1inch or Paraswap that split the swap operation between different liquidity pools to achieve the lowest slippage. But what if we need to perform a cross-chain swap? How do we split the swap between DEXes in different blockchains? Let’s see if there will be cross-chain aggregation solutions once we have true interoperability.

- Fragmentation of competitive environments. Lack of interoperability solutions leads to the situation where all the projects have to compete locally — PancakeSwap with BakerySwap in BSC, Uniswap with Sushi in Ethereum, Raydium with Saber in Solana. But what if users could perform their swaps with PancakeSwap or Raydium simultaneously and be able to decide which DEX provides the better rates? That’s what we will have in the near future when we have cross-chain interoperability, and PancakeSwap will have to compete with Raydium, Saber, and all other DEXs at the same time. And importantly, this applies not only to DEXs but to all types of protocols in the blockchain ecosystem.

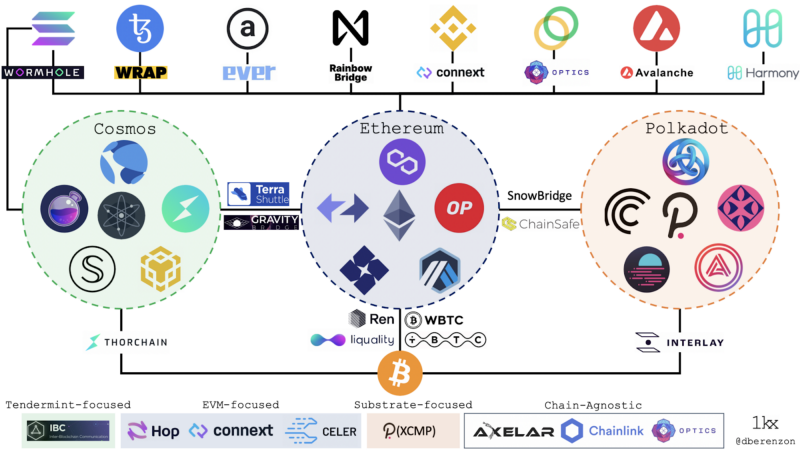

Let’s talk bridges and the current landscape:

Today, there are various blockchains and many bridges. Some of them are generalized, and some are chain-specific. Each time a user wants to perform a transfer from one blockchain to another, the person has to do thorough research:

- What chains do these bridges support?

- Is the wrapped asset liquid?

- Is the bridge decentralized?

Every bridge has different functionality and UI which makes the user experience difficult and more complex. The main problem is that there’s no unified solution where users could just pick “chain from” and “chain to” where all the complicated processing will happen under the hood.

Even better would be that a user could just go to their wallet and swap one asset to another in a different chain without knowing that there was a bridge involved. The user just receives the desired asset as intended by the UI, ultimately providing a similar experience to how people use the Internet without knowing how TCP/IP works.

It turns out that bridging of assets is not enough in order to achieve true cross-chain interoperability. The most important part is to have the ability to transfer any arbitrary data cross-chain. deBridge aims to be the TCP/IP of blockchains, inclusive to all!

The receiver of the message should know who the sender was in the original chain. If a smart contract on AAVE in Ethereum sends a command to a smart contract in Polygon to account for a certain amount of collateral to a user, the smart contract in Polygon should understand that this message was received from a trusted sender which in this case is the smart contract in Ethereum.

Another challenge is when someone needs to trigger a transaction in the target chain in order to have the message delivered. Users may not have the native asset to pay for gas and they don’t want to manually switch networks in their wallet. As a result, someone needs to trigger the transaction. This is where keepers come in which can be by any arbitrary wallet or user that will trigger the transaction in the target chain to enable a more seamless and effective experience to do any type of cross-chain bridging.

With great interoperability comes great use cases

There are various use cases that will be enabled with cross-chain interoperability. An example will be an algorithmic stablecoin protocol in Ethereum which opens positions on Mango Markets in Solana or Perpetual protocol in Arbitrum in order to maintain its peg. Keepers in charge of liquidation and arbitrage can monitor and take advantage of a wider pool of assets to tap into new opportunities.

NFTs is another use case where interoperability allows users to buy/sell NFTs directly from game interfaces, and not confined to one particular chain. Tokenized media like music, generative art, and videos will enable artists to leverage their fan base cross-chain.

Moreover, DAOs are another area with great use cases. Imagine being able to interact with thousands of token holders all coming from dozens of chains. This is how we begin to envision a global ecosystem where proposal making, voting, and execution can be performed with a single UI. For example, as a token holder of a lending protocol, you shouldn’t lose your governance rights if you hold the tokens on a newly deployed chain.

deBridge abstracts away the complexities of composability, so that frontend dApps like wallets and yield generating protocols can use deBridge under the hood. Instead of users only interacting with the deBridge UI, in the future, there will be many B2B use cases, whereby the infrastructure works reliably to enable more innovation to be built on top of it.

Ready for the multi-chain ecosystem?

The future will certainly be multi-chain and there will be different interoperability solutions. It’s just a matter of execution and the projects that will be able to integrate with most blockchain networks, provide the best decentralization, user experience, and security.

deBridge has just begun, and we’re excited to see what comes next. Keep up with the newest developments, obtain developer support, and interact with other members of the community. We’re looking forward to the road ahead, and we’re glad to have you along for the ride!

About deBridge

deBridge is a cross-chain interoperability and liquidity transfer protocol that allows decentralized transfer of assets between various blockchains. The cross-chain intercommunication of deBridge smart contracts is powered by a network of independent oracles/validators elected by deBridge governance. deBridge protocol is an infrastructure platform and hooking service for:

- Cross-chain composability of smart contracts

- Cross-chain swaps

- Bridging of any arbitrary asset and data

- Interoperability and bridging of NFTs